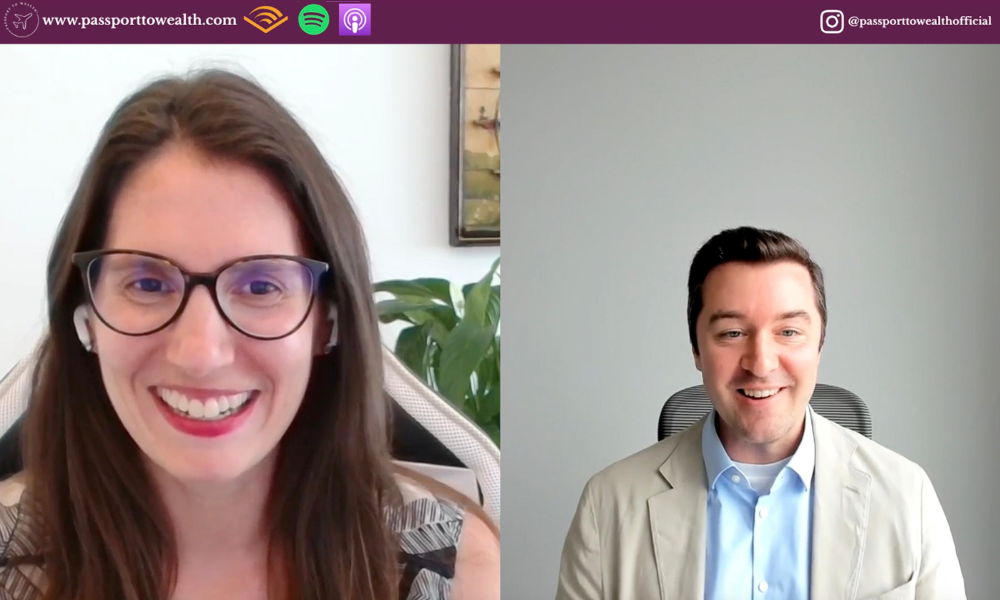

What U.S. Expats Need to Know About PFICs with Matthew Hitchcock, CPA

In this week’s episode of Passport to Wealth™, host Arielle Tucker,CFP®, EA sits down with Matthew Hitchcock, CPA, founder and managing partner of Hitchcock and Partners GmbH, a boutique tax and advisory firm based in Zurich. With over 15 years of international tax experience across the U.S. and Europe, Matthew offers a clear and candid look into one of the most misunderstood and costly issues facing U.S. expats: PFICs (Passive Foreign Investment Companies).

“You never want to make investment decisions based solely on tax complexity. But if you’re living abroad, you need to understand what PFICs are because they can create compliance headaches and tax surprises that far outweigh the investment itself.”

What Is a PFIC—and Why Should Expats Care?

A Passive Foreign Investment Company (PFIC) is a foreign-based investment fund, often a mutual fund, ETF, or pooled investment, classified under a special set of punitive U.S. tax rules. These rules aim to prevent U.S. taxpayers from deferring taxes by investing in offshore funds.

While PFIC regulations were initially created for high-net-worth individuals, they now frequently impact everyday Americans living abroad who invest in local financial products.

“A PFIC is basically any non-U.S. investment that earns mostly passive income. For Americans abroad, it often shows up in foreign brokerage accounts, retirement plans like Switzerland’s Pillar 3, or when buying local mutual funds.”

Why PFICs Matter for U.S. Expats

PFICs come with punitive tax treatment, intensive reporting requirements, and high compliance costs. Even small investments, like those in local retirement accounts, can trigger complex U.S. tax filings and higher professional fees.

“You could have $8,000 in a Pillar 3 account and still face hundreds or thousands in reporting costs,” Arielle shared.

In addition, PFICs can keep the IRS statute of limitations open indefinitely, increasing long-term audit risk if they are not reported properly.

PFIC Reporting Thresholds

Matthew broke down the reporting requirements:

- $25,000 or more in direct ownership requires Form 8621

- $5,000 or more in indirect ownership via partnerships may also trigger reporting

- Below these thresholds, some individuals may be exempt, but the margin is narrow

There’s no universal rule. Each situation requires analysis of the investment structure, type of income generated, and available documentation.

The Cost of Getting It Wrong

Failing to report a PFIC correctly can result in:

- Punitive taxation through “excess distribution” rules

- Loss of preferential rates on capital gains and dividends

- Extended IRS audit risk due to open statutes

- Unexpected tax bills upon distributions or sale

“Even a small fund sale could trigger a retroactive tax calculation at the highest rates,” Matthew warned. “In some cases, total tax exposure can exceed 50%.”

Where Expats Encounter PFICs

Common sources of PFIC exposure include:

- Foreign mutual funds and ETFs

- Local retirement or pension accounts (like Switzerland’s Pillar 3a)

- Investment recommendations from non-U.S. advisors

- DIY international investing without U.S. tax awareness

“What works for non-U.S. citizens abroad won’t work for Americans,” Arielle noted. “U.S. citizens live under an entirely different tax regime.”

Fixing PFIC Mistakes

Many expats unknowingly make PFIC-related errors, especially when using DIY software. The good news: it’s often possible to correct past mistakes with the right help.

“The biggest risk is assuming your return is safe because it’s been filed,” Matthew explained. “If a PFIC isn’t reported, the IRS can revisit that return at any point in the future.”

Working with a qualified U.S. tax advisor is the best way to address compliance gaps and determine whether amended returns or disclosures are needed.

Strategies to Avoid PFICs

Expats can reduce their exposure by:

- Avoiding foreign mutual funds and pooled investment vehicles

- Consulting with a U.S.-qualified advisor before investing abroad

- Staying cautious about local retirement products

- Educating themselves early to prevent future issues

“Most PFIC mistakes happen simply because people don’t know the rules,” Matthew said. “Awareness is the first step.”

Final Thoughts

PFICs remain one of the biggest compliance traps for U.S. expats: impacting taxes, investment performance, and peace of mind. This episode offers a clear overview of what PFICs are, how they work, and the steps individuals can take to avoid costly mistakes while living abroad.

Connect with Our Guest

To learn more about Matthew Hitchcock, CPA, and his work helping U.S. expats navigate international tax challenges, visit:

- LinkedIn: https://www.linkedin.com/in/matthew-d-hitchcock-cpa-46231a19/

- Website: https://hitchcockcpa.ch/en-ch/

More About Our Author

Arielle Tucker, CFP®, EA, is the founder of Connected Financial Planning and the host of Passport to Wealth™. As a Certified Financial Planner™ and Enrolled Agent, Arielle specializes in helping U.S. expats simplify their finances while building intentional, global lives.

With firsthand experience navigating cross-border living, tax complexity, and international relocation, Arielle provides thoughtful, personalized guidance for individuals and families living abroad. Whether you're planning a move, managing multi-country income, or just trying to make sense of your financial future; she’s here to help you do it with clarity and confidence.

To book a 1-1 Expat Expert Coaching Call with Arielle, please do so here: Passport to Wealth | Contact